Trusted Business Currency Exchange for Global Payments

Effortless global payments with tailored FX solutions to grow your business. Access 130+ currencies across 190 countries, backed by 45 years of risk management expertise.

Why choose us for international currency exchange?

Backed by 45 years of experience, strong compliance, and partnerships with leading banks, we offer regulatory assurance, competitive rates, and tailored solutions that blend the agility of a boutique with the innovation of a fintech.

Manage FX exposure with Market Orders, Forward Contracts, and advanced Risk Management tools

FCA-regulated with 60+ global licences including 2 bank licenses*

Direct access to global and local payment rails including SWIFT, SEPA, BACS, CHAPS, ACH, Faster Payments, FedWire, CHIPS & PIX

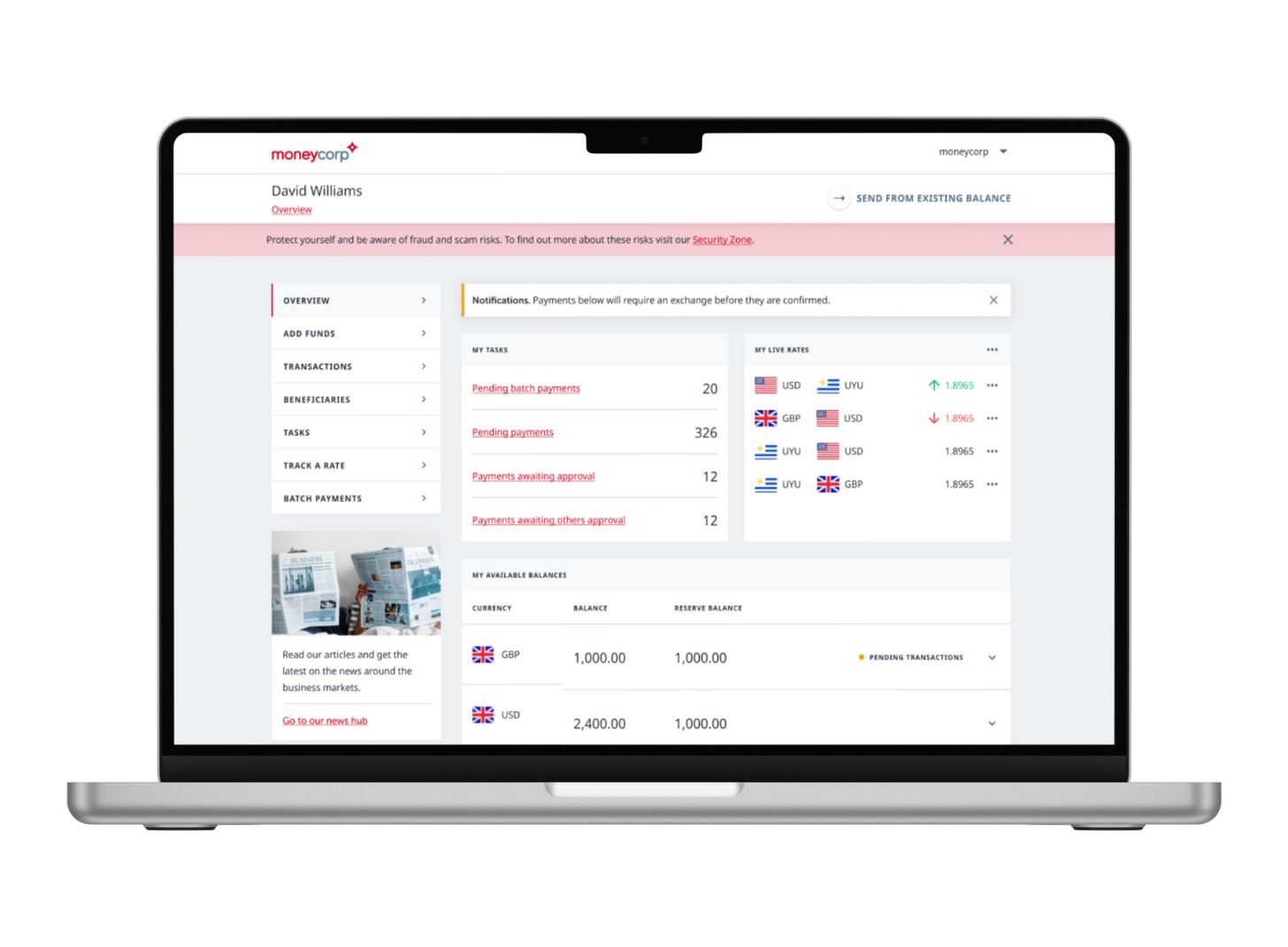

Online multi-currency account with 24/7 access and live FX rates

Trusted by over 40,000 clients, with a total trading volume exceeding £70.95bn**

*Our two licences from the Central Bank of Ireland are passported across every country in Europe under ‘freedom of service’. Furthermore, we have obtained ‘freedom of establishment’ permissions from local regulators in Spain, Romania and France. Moneycorp Group hold 62 financial services regulatory licences and registrations (including 2 banking licences) issued by various regulatory authorities in the jurisdictions we operate.

**Trading volume represents flow measured as single leg transaction volume. These figures represent the entire Moneycorp Group, taken from the group annual report 2023

FX Solutions for International Business Transfers

Multi-currency account

Manage international transactions in multiple currencies from one account. Our multi currency business bank account helps reduce conversion fees, streamline operations, and improve cash flow visibility across markets.

Create account

FX Forward contracts

Secure future exchange rates with our forward FX rates to protect your business from currency fluctuations and plan international payments with confidence.

Explore forward contracts

Risk management

Protect your business from foreign exchange market volatility, forecast cash flows and minimise risk with our range of hedging tools including FX orders and FX options.

Explore risk management solutions

A forward contract* allows you to agree a fixed exchange rate for a future transfer when facilitating payment for goods, services, or direct investment.

Personalised FX Risk Management

Get personalised guidance from your own FX specialist who understands your business and its international payment needs. From setting up your multi-currency business account to choosing the right hedging tools, your account manager will work with you to optimise your strategy and help protect your bottom line.

Hedging Foreign Exchange Risk

Streamline international payments and currency transfers with our full suite of foreign exchange tools. From forward contracts and FX orders to FX options and spot contracts, we offer flexible solutions to help you forecast cash flows and manage global transactions efficiently. Plus, enjoy 24/7 access to your multi-currency business account for real-time trading and reporting.