Working together with Chinese businesses in Canada

Supporting businesses in Canada to help streamline CAD to RMB payments like never before.

Foreign Exchange and Risk Management for Canadian-Chinese businesses

4 minute readAccording to the Government of Canada, since 2001 Canada’s relationship with China has grown faster than their trade relationships with any other global partner, leading China to become Canada’s second-largest trading partner.

As businesses continue to globalize and technology continues to advance, most Canadian-Chinese import and export businesses settle their international transactions in USD. Many of these businesses face two layers of FX risk that may increase costs and affect profits as a result of currency fluctuations. For example, most SMEs import from China and pay in US dollars, even though sales are in Canadian dollars. This causes businesses to experience FX risk in both CAD to USD and USD to RMB because their suppliers have to convert the USD receivables to RMB and will normally transfer such costs to their overseas buyers when pricing in USD.

With our in-depth knowledge about guided Foreign Exchange and Risk Management strategies, Chinese-Canadian business owners may be able to take their business to the next level. Continue reading to learn more about how FX risk management strategies may help benefit your CAD/RMB and USD/RMB exchanges.

“By reducing the number of currency conversions between companies and switching from USD to Renminbi (RMB) invoicing, Chinese-Canadian businesses can protect the bottom line and indulge in profitable trade”

What is FX Risk Management and Hedging?

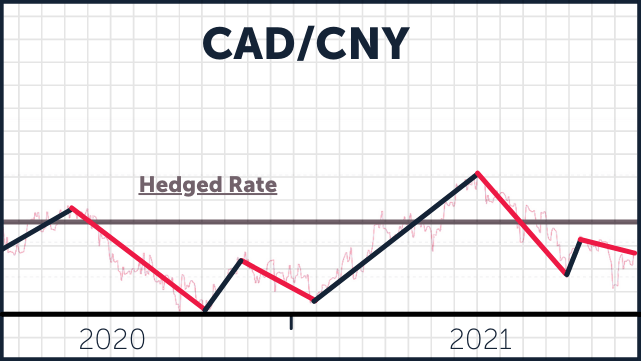

Simply put, implementing an FX risk management strategy can help minimize business losses from market volatility. With ever-present market fluctuations, businesses can no longer expect to successfully run their cross-border operations without a proactive and strategic approach to managing currency market risk. (See the simple example graph below)

While doing business internationally already comes with its own set of operational challenges, ineffectively navigating the currency market can take your risk even further leading to an unfavorable impact on your firm’s bottom line. For example, from May 2019 to March 2020, the USD/CAD rate rose by 13% from 1.2960 to 1.4670, this 13% rise in the exchange rate would cost importers a more than 140% decrease on their bottom line. Additionally, from March 2020 to March 2021, the USD/CAD rate dropped 16% from 1.4670 to 1.2365. This 16% drop, unless effectively hedged, would cost exporters more than a 75% decrease in net profit. These simple examples can be a potential model for each currency pair your business operates in, highlighting the importance of guided FX risk management and hedging strategies for all importers and exporters.

Streamline Your Payments to and From China

Our FX experts not only speak the local language but also understand China’s challenges as well as opportunities, making Moneycorp the perfect partner for CNY payments.