Business growth in 2021

Discover what activity SME’s are planning to make, region by region, post Brexit and Covid-19

5 minute readThe British Chambers of Commerce, in partnership with moneycorp, surveyed more than 1,000 UK businesses to understand the impact of Covid-19 and Brexit. Discover how individual regions have been affected and what's next for them here.

For national level results please visit our article covering key takeaways from the business growth report.

As Europe still comes to terms with a new post-Brexit landscape, many businesses are now evaluating what the new processes will mean for trade between the UK and the continent.

Growth in and outside the EU

When asked about international growth, one in four businesses in the Midlands told of their plans to expand to countries outside of the EU, compared to one in five who still intend to grow within the EU. The numbers across the country generally mirrored the overall national outlook, although Scotland revealed the highest percentage (32%) of businesses with plans for international growth outside of the EU over the next twelve months compared to other regions in the UK. More comparably, one in four Scottish businesses revealed plans to grow internationally, but inside the EU.

The intention or concrete plans to grow within the following areas over the next 12 months*

|

| ||

| North of England | 24% | 29% |

| Midlands | 22% | 26% |

| South of England | 22% | 29% |

| Scotland | 26% | 32% |

*Businesses could choose more than one area

Sources of finance

41% of businesses based in the North of England don’t intend to use or continue to use any forms of financial assistance, the highest percentage out of all the regions surveyed. 23% of northern businesses are already taking advantage of, or are planning to use the Bounce Back Loan Scheme (BBLS), with that number rising to 28% in the South of England. Interestingly in the Midlands, the need for the BBLS scheme was equally matched with intending to use or currently using the Coronavirus Business Interruption Loan Scheme (CBILS) and overdrafts.

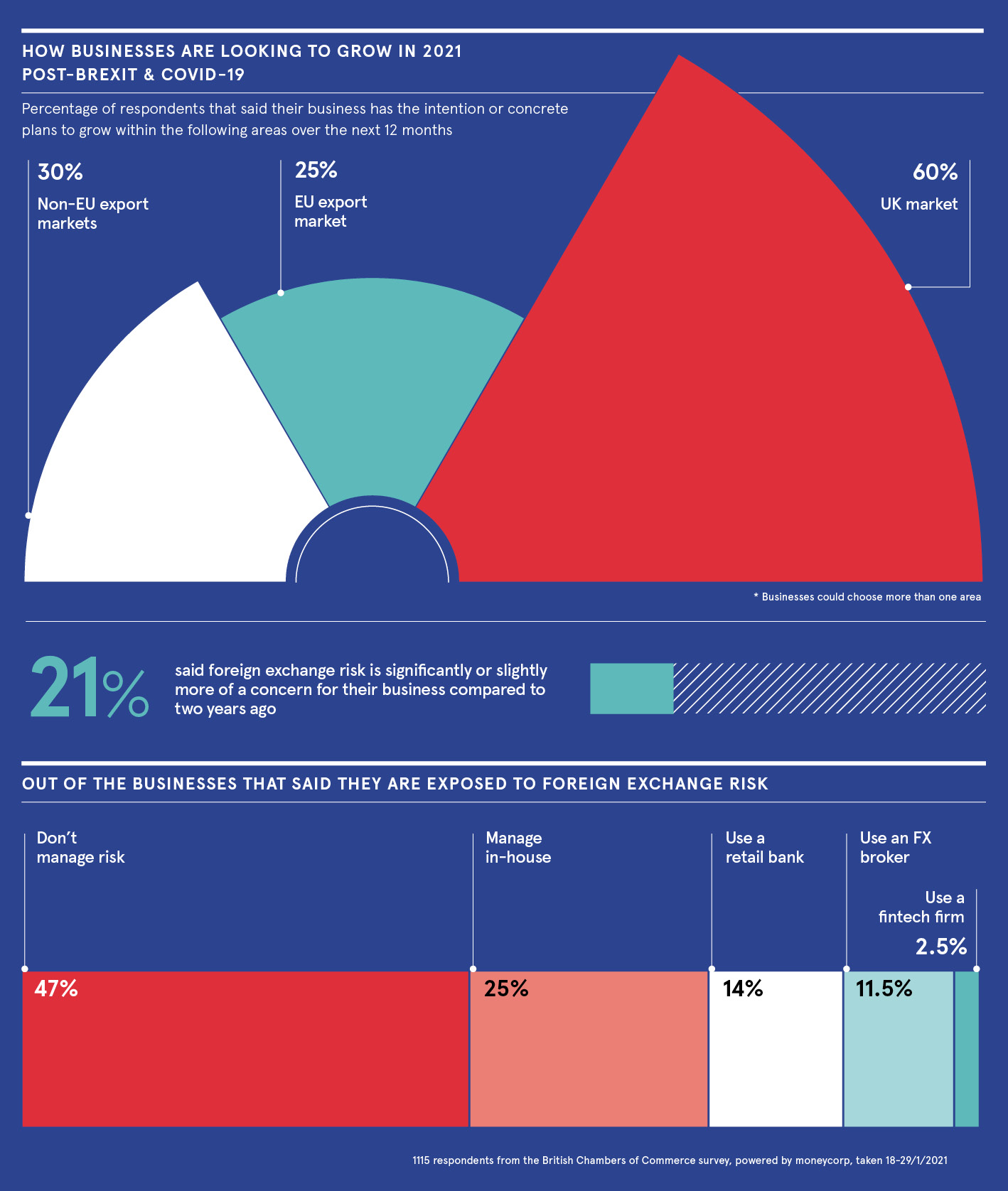

Risk when sending international payments

21% of businesses said that foreign exchange risk is significantly or slightly more of a concern for their business compared to two years ago. Worryingly, out of the SMEs who said that they are exposed to foreign exchange risk, 47% don’t manage risk at all, as you can see in the infographic. 25% of the businesses exposed to FX manage their risk, and therefore international payments in-house. Scottish businesses and those in the Midlands were slightly more likely to admit they don’t manage their risk, but Scottish businesses were also most likely to manage risk in-house. Businesses in the north of England were least likely to use a specialist international payments provider compared to the other regions.

Why leave it to chance?

The reasons for why businesses don’t manage their exposure to the foreign exchange markets interestingly was quite varied. While on a national scale the price of financial products was mentioned as the top reason, despite foreign exchange health checks demonstrating how managing such risk can actually save money, not all regions agreed.

Price was the number one reason for northern SMEs, but for businesses in the Midlands, a lack of information on products and services cropped up. Businesses can find out more information on areas that can lead to exposure and potentially affect their bottom line with guidance on importing and exporting, which could negate some of these worries on understanding FX markets. Contract restraints, such as with suppliers is also a reason why businesses don’t hedge their currency risk, and was mentioned by SMEs in the south of England.

However, leaving international payments up to chance could leave businesses out of pocket. Across Q1 2021, the pound strengthened by over 20% against the dollar since March 2020, and 8% against the euro. That means that if businesses were exchanging GBP 100,000, there would be a difference of USD 25,000 and EUR 9,000 respectively.

Being proactive and conducting a full risk assessment could make vital savings, and doing this can be more cost-efficient if you speak to an international payments specialist.