What does IBAN stand for?

3 minute readIBAN stands for International Bank Account Number, although is commonly referred to as an ‘IBAN’ or ‘IBAN number’. An IBAN contains up to 34 numbers and letters, including a country code, bank identification number, two check digits, bank account number and other routing information.

What is an IBAN number?

An IBAN code helps banks in different countries to identify your account, reducing the chance of an error or miscommunication when processing an international payment.

You will need to provide your IBAN to anyone intending to send you funds, while you may also need the IBAN of anyone you wish to make an overseas payment to (provided their account has one).

Does every country use IBAN for international payments?

While a number of countries process foreign payments using IBAN numbers, they aren’t used across the entire world. Over 70 countries have adopted the IBAN numbering system, however notable exceptions include USA, Australia, and New Zealand. In addition, the regulations in some countries deem the use of IBAN numbering as mandatory, while others simply recommend it.

Most of Europe use IBAN codes, as do some areas of Africa, Central America and the Middle East.

How long is an IBAN number?

An IBAN can have between 16 and 34 alphanumeric characters, depending on the country in which the bank account is opened in. In the UK, your bank account will have an IBAN containing 22 characters, and will always begin with the letters GB followed by the numbers 29.

How to find IBAN number

Finding your IBAN code is relatively straightforward, however can differ depending on the country your bank is located in. Most online banking platforms or banking statements will provide you with your IBAN, and BIC (Swift) Code, as well as your account number and sort code.

If your bank is in the UK, you can even figure out your IBAN by yourself if you can’t find it on your online account or statement. The formula is the same for everyone with a UK bank account and is as follows (minus the hyphens):

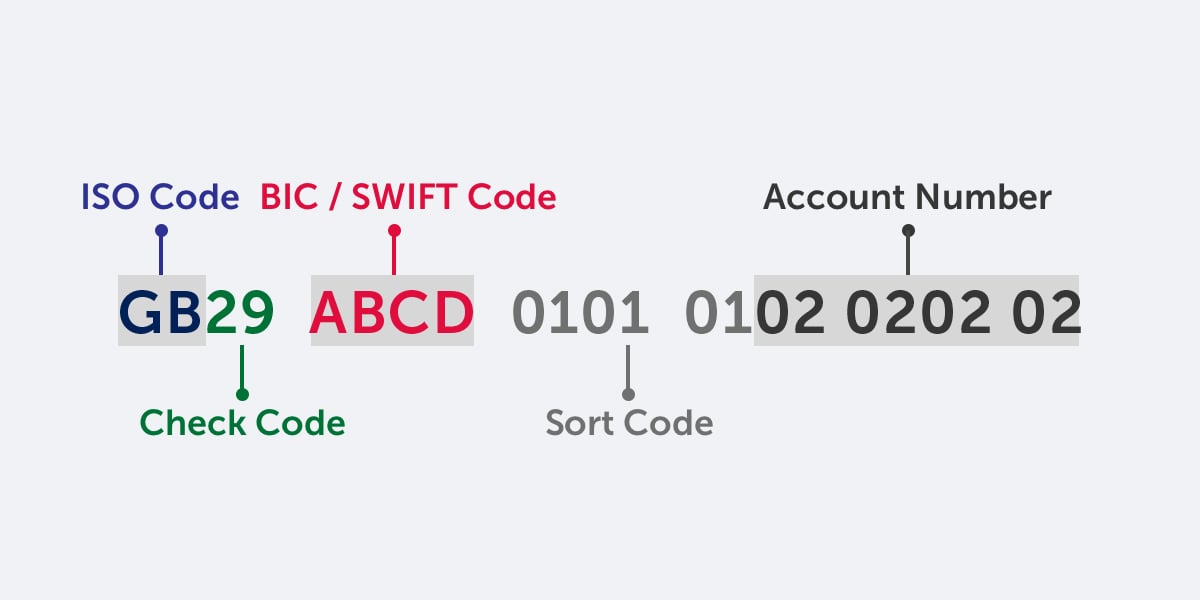

ISO code – Check Code – First 4 digits of BIC (Swift) Code – Sort Code – Bank Account Number

Below is an example of how this IBAN would look in print format. This example is for a fictional Barclays customer with the Sort Code: 01-01-01 and the Account Number: 0202020202.

GB29 BUKB 0101 0102 0202 02

If you’re having trouble finding or figuring out your IBAN, it’s always a good idea to speak to your bank either in person or over the phone to ask where to find your IBAN before potentially providing the wrong one and adding complications to receiving funds.

Virtual Euro IBAN for online sellers

If you’re an online seller based in the UK and listing your goods on European online marketplaces, you will require an IBAN to transfer your money between currencies. With a Moneycorp online seller account, you can receive your own Euro IBAN for your online seller business, and enjoy competitive exchange rates when you convert your earnings from euro to pound.